How investors gauge your opportunity - beyond your business model.

I ran an experiment to challenge if the Business Model Canvas actually enables founders to communicate their business models more succinctly. At Leancamp Dublin, I hosted 90-second Business Model Canvas pitches to 4 well-respected Venture Capitalists. We asked the VCs to question the founders and then comment on the their communication ability, rather than their idea.

The Canvas helped – almost all managed to describe their business well in 90 seconds – but a clear problem with the pitches was highlighted from the investors’ questions.

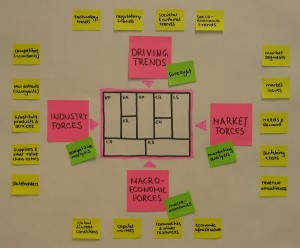

Their most consistent question beyond the value proposition, customer problem and target customers were about the growth and adoption trends, competition and market size. The investors were sizing up the opportunity by looking at the context and starting point for the business. It became clear that to explain the full opportunity quickly, the canvas had to be augmented with the Business Model Environment.

The Business Model Environment is covered in Alex Osterwalder’s original book, Business Model Generation, but it’s often overlooked. It keeps a clear distinction between what’s part of your business model, and what isn’t – drawing the border at what’s within your control.

The Environment consists of 4 types of factor:

- Market Forces

- Industry Forces

- Trends

- Macro-Economic Factors

Just as you can use the canvas to identify, record and test hypotheses about your customers and business model dynamics, by including the Environment, you can roll in broader tests. Without skipping a beat, it easily connects your thinking and process to the other valuable perspectives like Disruptive Innovation, Porter’s 5 Forces, and Mullin’s New Business Road Test, allowing you to apply their thinking in a particularly clear and immediate way.

It gives you a place to record those things that are relevant but not part of the business models you’re testing . Without hacking the canvas, and without losing the benefits of the common visual language. For example, a key check for a Disruptive opportunity is if adoption rates are doubling, even though the current market is small. This connects Trends and Customer Segments clearly.

While the tools we choose, like the Business Model Canvas, can give us a quick boost, this highlights the importance of properly educating ourselves about it if it’s going to be key. So many investor meetings are dismissed by founders, as “that investor just doesn’t get it,” but in a lot of cases, we’re the ones that are missing something.

What am I up to these days?

I’m a new parent, and prioritising my attention on our new rhythms as a family.

Work-wise, I’m trekking along at a cozy pace, doing stuff that doesn’t require meetings :)

I have a few non-exec/advisory roles for engineering edu programs. I’m also having fun making a few apps, going deep with zero-knowledge cryptography, and have learned to be a pretty good LLM prompt engineer.

In the past, I've designed peer-learning programs for Oxford, UCL, Techstars, Microsoft Ventures, The Royal Academy Of Engineering, and Kernel, careering from startups to humanitech and engineering. I also played a role in starting the Lean Startup methodology, and the European startup ecosystem. You can read about this here.

Books & collected practices

- Peer Learning Is - a broad look at peer learning around the world, and how to design peer learning to outperform traditional education

- Mentor Impact - researched the practices used by the startup mentors that really make a difference

- DAOistry - practices and mindsets that work in blockchain communities

- Decision Hacks - early-stage startup decisions distilled

- Source Institute - skunkworks I founded with open peer learning formats and ops guides, and our internal guide on decentralised teams

Other thoughts

Don't miss The Floop (2024)

Some kind of parent (2024)

Exploring Istanbul: Beyond the conference bubbles (2023)

Retreats for remote teams (2023)

What do you need right now? (2023)

Building ecosystems with grant programs (2021)

Safe spaces make for better learning (2021)

Choose happiness (2021)

Working 'Remote' after 10 years (2020)

Emotional Vocabulary (2020)

Project portfolios (2020)

Expectations (2019)

Amperage - the inconvenient truth about energy for Africa's off-grid. (2018)

The history Of Lean Startup (2016)

Get your loved ones off Facebook (2015)

Entrepreneurship is craft (2014)